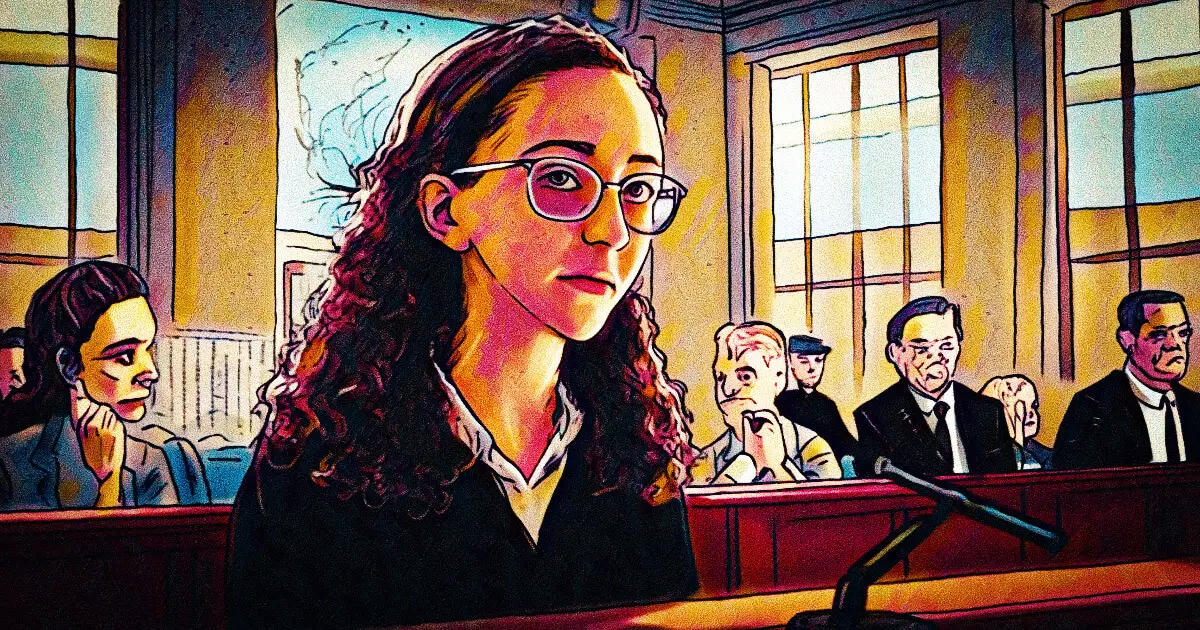

Caroline Ellison, previously at the helm of Alameda Research and once romantically linked to the controversial Sam Bankman-Fried (SBF), has become emblematic of the broader fallout from the FTX debacle. Recently sentenced to two years in prison and ordered to forfeit an astonishing $11 billion, Ellison’s case highlights the complexities surrounding corporate accountability, personal integrity, and the consequences of financial mismanagement in the cryptocurrency sphere. Her situation serves as a stark reminder of the intricate links between personal relationships and professional responsibilities.

Ellison’s defense argued extensively for leniency, primarily based on her cooperation with federal authorities, claiming her testimony was instrumental in securing SBF’s conviction—a judgment that resulted in a severe 25-year sentence for multiple counts of fraud. This narrative sheds light on the delicate balance between whistleblowing and self-preservation in legal contexts. Ellison voluntarily returned to the United States from the Bahamas, showcasing her commitment to aiding investigators in untangling the complex financial web woven by FTX and its affiliates. This aspect of her case raises challenging questions: How should the legal system weigh the contributions of individuals who initially participated in malfeasance but later assist in uncovering broader wrongdoings?

In the courtroom, Ellison’s legal team accentuated her previously spotless record and incorporated character references to argue for a more lenient sentence, exploring a psychological narrative that framed her actions as the result of manipulation by SBF. This angle introduces significant discourse about accountability in corporate environments, particularly how charisma and influential leadership can warp ethical decision-making. The suggestion that Ellison felt coerced into unlawful activities due to her relationship with SBF opens a complex dialogue about the vulnerabilities faced by individuals within hierarchical structures.

The sentencing of Ellison is part of a larger wave of scrutiny directed toward former executives of FTX. With additional figures like Ryan Salame receiving substantial sentences and others awaiting their fates, the repercussions of the FTX collapse extend far beyond individual actors. Prosecutors have painted a comprehensive picture of misconduct, alleging that customer funds were diverted for personal gain and risky ventures. This misappropriation raises pressing ethical questions about the governance structures in crypto firms, where transparency and accountability often lag behind rapid innovation and speculative investment.

As the repercussions of the FTX incident continue to unfold, the case against Ellison serves as a critical lesson in the importance of robust regulation and ethical standards in the cryptocurrency domain. The landscape of digital finance remains complex and unregulated, and the fallout from FTX emphasizes the urgent need for frameworks that protect investors and hold executives accountable for their decisions. As members of the cryptocurrency community watch these legal outcomes unfold, there is a collective hope that enhanced regulations will emerge, lending security and integrity to a sector marred by scandals and questionable practices.

Caroline Ellison’s sentencing encapsulates the multifaceted legal, ethical, and psychological dimensions inherent in the FTX collapse, urging stakeholders to contemplate the importance of integrity, transparency, and responsibility in shaping the future of digital finance.

Leave a Reply