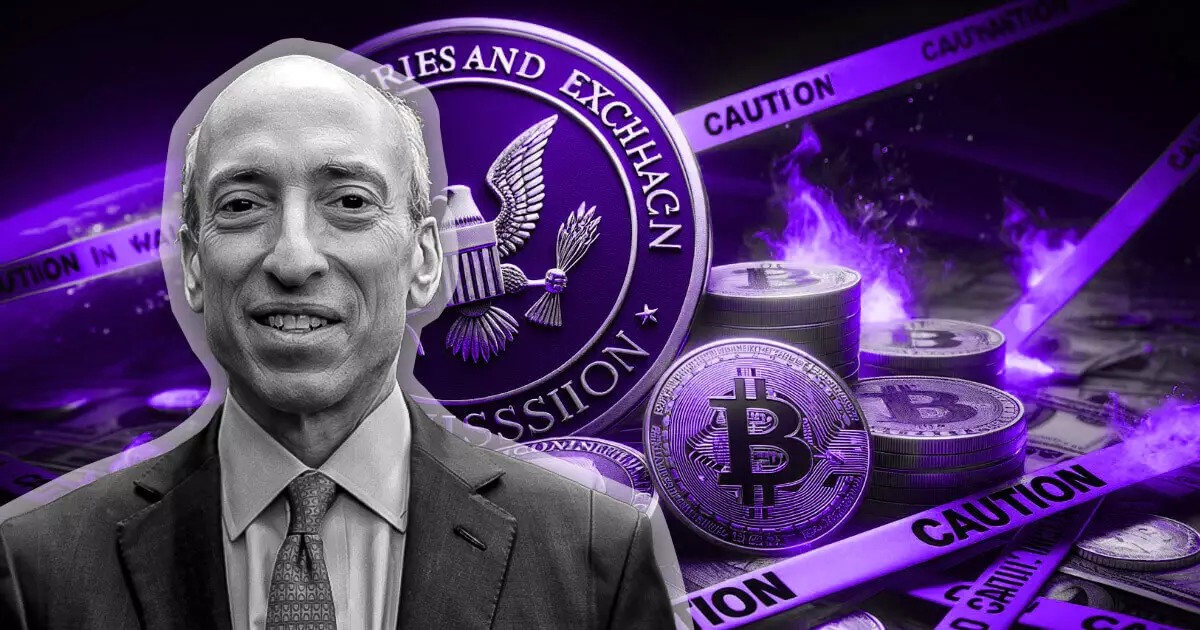

In the complex and evolving world of cryptocurrency, regulatory clarity is critical for both investor confidence and market stability. Recently, the Chair of the US Securities and Exchange Commission (SEC), Gary Gensler, emphasized that Bitcoin is not a security under US law, reaffirming its classification as a commodity. This declaration works to provide some much-needed clarity amidst a climate of uncertainty for the broader cryptocurrency sector, which is often criticized for its lack of compliance with regulatory standards. Gensler’s remarks, made during a CNBC interview, seek to anchor Bitcoin’s regulatory framework firmly, especially following the SEC’s approval of multiple Bitcoin exchange-traded funds (ETFs). This approval marks an important milestone and signals that Bitcoin is being integrated into mainstream financial markets.

Despite the clear classification of Bitcoin, Gensler expressed concerns over other areas within the crypto industry. He has been vocal about the regulatory compliance issues that plague many cryptocurrency projects. Gensler contends that numerous industry leaders openly disregard established regulations, thereby undermining the efforts of compliant participants and creating an environment of chaos. The SEC chair asserts that “there are rules in place, but many have chosen to ignore them,” highlighting the disconnect between regulatory expectations and the actions of some market participants. This non-compliance is not just a nuisance; it contributes to market instability, generating confusion for investors and regulators alike.

In contrast to Bitcoin, regulatory clarity surrounding Ethereum remains murky. The SEC has yet to classify Ethereum conclusively as either a security or a commodity, leading to a precarious situation for projects built on its blockchain. The ongoing scrutiny not only affects regulatory perspectives but also creates a chilling effect on innovation in the Ethereum ecosystem. Gensler’s recent actions, which include investigations into Ethereum-related companies such as Consensys and Uniswap, position Ethereum in a state of uncertainty that could hinder its growth compared to Bitcoin.

Gensler’s approach has also drawn ire from various members of Congress, many of whom argue that his intricate terminologies, such as “crypto asset security,” contribute to regulatory confusion rather than alleviating it. A recent congressional hearing revealed a critical sentiment among lawmakers who feel that the SEC’s regulatory approach might stifle innovation and entrepreneurship in the crypto space. Even fellow SEC Commissioners like Hester Peirce and Mark Uyeda have expressed disappointment with the regulator’s perceived inability to provide much-needed clarity to industry players, suggesting that more precise guidance is overdue.

Despite facing significant criticism, Gensler insists that a robust regulatory framework is essential for the future of the crypto industry. He argues that building “investor trust” is fundamental to the market’s longevity and success. Drawing an analogy to the evolution of other industries, he likens regulations to essential traffic management tools—necessary for orderly progress. The contrasting approaches taken towards Bitcoin and Ethereum leave the larger crypto market in a limbo where hopes for clarity and growth must navigate through the complexities of regulatory oversight. Without a concerted effort to establish comprehensive guidelines, the broader cryptocurrency landscape may remain fraught with uncertainty, affecting innovation and investor confidence for years to come.

Leave a Reply